OVERVIEW

API Transfer to Bank

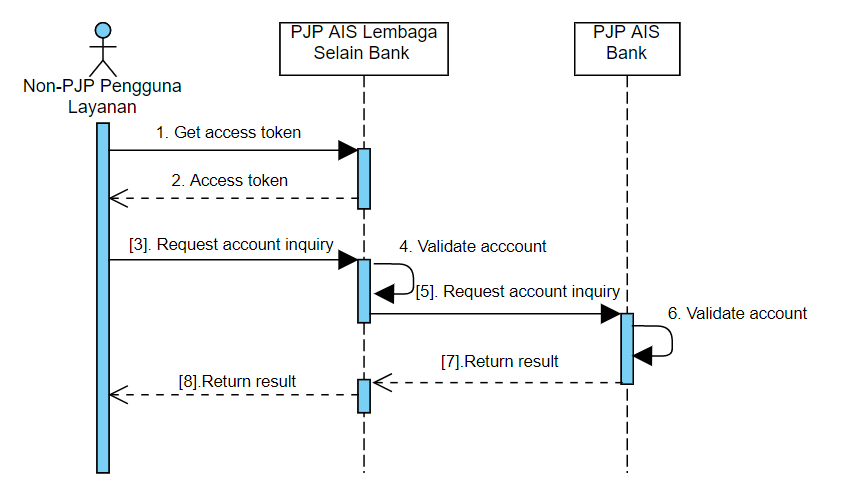

Sequence Diagram API Transfer to Bank-Account Inquiry

Informasi Umum

| Service Code | 42 |

|---|---|

| Name | API Transfer to Bank-Account Inquiry |

| Version | 1.0 |

| HTTP Method | POST |

| Path | .../{version}/emoney/bank-account-inquiry |

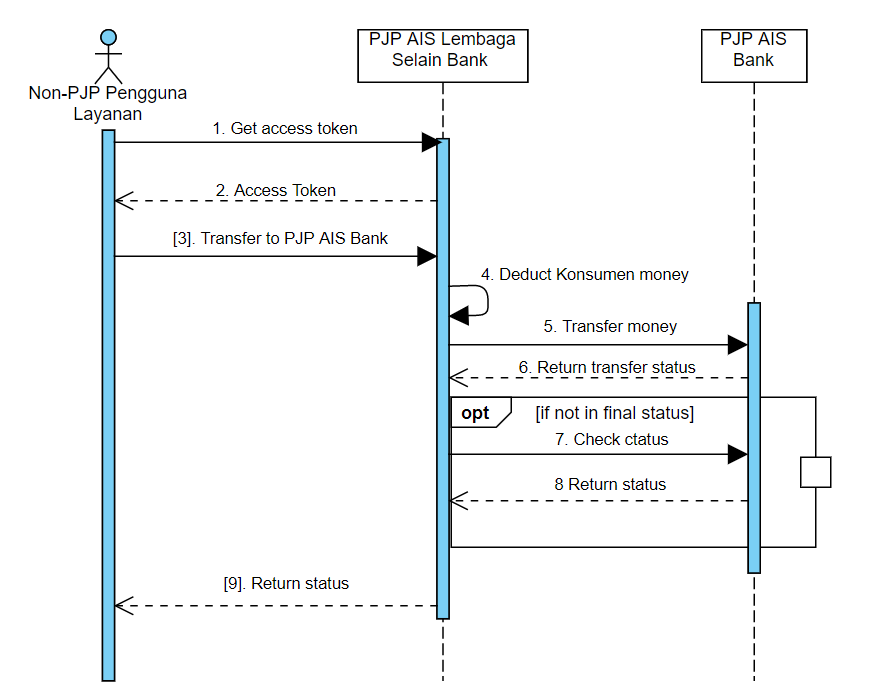

Sequence Diagram API Transfer to Bank-Payment Transaction

Informasi Umum

| Service Code | 43 |

|---|---|

| Name | API Transfer to Bank-Payment Transaction |

| Version | 1.0 |

| HTTP Method | POST |

| Path | .../{version}/emoney/transfer-bank |

GUIDES

Spesifikasi Parameter Header dan Body API Transfer to Bank

Request Body

| Parameter | Data Type | Mandatory | Length | Description |

|---|---|---|---|---|

| partnerReferenceNo | String | O | 64 | Transaction identifier on service consumer system |

| CustomerNumber | String | M | 32 | Customer Account Number |

| amount | Object | M | ||

| value | String | M | 16,2 | Net amount of the transaction. |

| If it's IDR then value includes 2 decimal digits. | ||||

| e.g. IDR 10.000,- will be placed with 10000.00 | ||||

| currency | String | M | 3 | Currency (ISO4217) |

| beneficiaryAccountNumber | string | O | 32 | Destination account number |

| additionalInfo | Object | O | Additional information for custom use that are not provided by SNAP |

Response Body

| Parameter | Data Type | Mandatory | Length | Description |

|---|---|---|---|---|

| responseCode | String | M | 7 | Response code |

| responseMessage | String | M | 150 | Response description |

| referenceNo | String | C | 64 | Transaction identifier on service provider system. Must be filled upon successful transaction |

| partnerReferenceNo | String | O | 64 | Transaction identifier on service consumer system |

| accountType | String | O | 25 | Account type |

| beneficiaryAccountNumber | String | M | 32 | Beneficiary account number |

| beneficiaryAccountName | String | M | 64 | Beneficiary account name |

| beneficiaryBankCode | string | O | 11 | Bank code |

| beneficiaryBankShortName | string | O | 25 | Bank short name |

| beneficiaryBankName | string | O | 25 | Bank name |

| amount | Object | M | ||

| value | String | M | 16,2 | Net amount of the transaction. |

| If it's IDR then value includes 2 decimal digits. | ||||

| e.g. IDR 10.000,- will be placed with 10000.00 | ||||

| currency | String | M | 3 | Currency (ISO4217) |

| sessionId | string | O | 25 | sessionID |

| additionalInfo | Object | O | Additional information for custom use that are not provided by SNAP |

Request Body

| Parameter | Data Type | Mandatory | Length | Description |

|---|---|---|---|---|

| partnerReferenceNo | String | M | 64 | Transaction identifier on service consumer system |

| customerNumber | String | M | 32 | Customer Account Number |

| accountType | string | O | 25 | Account type |

| beneficiaryAccountNumber | string | M | 32 | Destination account number |

| beneficiaryBankCode | string | O | 11 | Bank code |

| amount | Object | M | ||

| value | String | M | 16,2 | Net amount of the transaction. |

| If it's IDR then value includes 2 decimal digits. | ||||

| e.g. IDR 10.000,- will be placed with 10000.00 | ||||

| currency | String | M | 3 | Currency (ISO4217) |

| sessionId | string | O | 25 | Session id |

| feeType | String | O | 25 | to whom the fee will be charged |

| additionalInfo | Object | O | Additional information for custom use that are not provided by SNAP |

Response Body

| Parameter | Data Type | Mandatory | Length | Description |

|---|---|---|---|---|

| responseCode | String | M | 7 | Response code |

| responseMessage | String | M | 150 | Response description |

| referenceNo | String | C | 64 | Transaction identifier on service provider system. Must be filled upon successful transaction |

| partnerReferenceNo | String | O | 64 | Transaction identifier on service consumer system |

| transactionDate | String | O | 25 | Format transaction date : (ISO 8601) YYYY-MM-DDThh:mm:ss |

| referenceNumber | string | M | 64 | Reference number |

| additionalInfo | Object | O | Additional information for custom use that are not provided by SNAP |

CODE SNIPPETS

Code Snippets API Transfer to Bank

Sample Request

POST .../v1.0/emoney/bank-account-inquiry HTTP/1.2

Content-type: application/json

Authorization: Bearer gp9HjjEj813Y9JGoqwOeOPWbnt4CUpvIJbU1mMU4a11MNDZ7Sg5u9a"

Authorization-Customer: Bearer fa8sjjEj813Y9JGoqwOeOPWbnt4CUpvIJbU1mMU4a11MNDZ7Sg5u9a"

X-TIMESTAMP: 2020-12-21T17:21:41+07:00

X-SIGNATURE: 85be817c55b2c135157c7e89f52499bf0c25ad6eeebe04a986e8c862561b19a5

ORIGIN: www.hostname.com

X-PARTNER-ID: 82150823919040624621823174737537

X-EXTERNAL-ID: 41807553358950093184162180797837

X-IP-ADDRESS: 172.24.281.24

X-DEVICE-ID: 09864ADCASA

X-LATITUDE: -6.1617169

X-LONGITUDE: 106.6643946

CHANNEL-ID: 95221

{

"partnerReferenceNo":"2020102900000000000001",

"customerNumber":"6281388370001",

"amount":{

"value":"10000.00",

"currency":"IDR"

},

"beneficiaryAccountNumber":"8377388292",

"additionalInfo":{

"deviceId":"12345679237",

"channel":"mobilephone"

}

}

Sample Response

Content-type: application/json

X-TIMESTAMP: 2020-12-21T17:07:18+07:00

{

"responseCode":"2004200",

"responseMessage":"Request has been processed successfully",

"referenceNo":"2020102977770000000009",

"partnerReferenceNo":"2020102900000000000001",

"accountType":"tabungan",

"beneficiaryAccountNumber":"2452451341",

"beneficiaryAccountName":"John Doe",

"beneficiaryBankCode":"003",

"beneficiaryBankShortName":"BMRI",

"beneficiaryBankName":"Mandiri",

"amount":{

"value":"10000.00",

"currency":"IDR"

},

"sessionId":"0UYEB77329002HY",

"additionalInfo":{

"deviceId":"12345679237",

"channel":"mobilephone"

}

}

Sample Request

POST .../v1.0/emoney/transfer-bank HTTP/1.2

Content-type: application/json

Authorization: Bearer gp9HjjEj813Y9JGoqwOeOPWbnt4CUpvIJbU1mMU4a11MNDZ7Sg5u9a"

Authorization-Customer: Bearer fa8sjjEj813Y9JGoqwOeOPWbnt4CUpvIJbU1mMU4a11MNDZ7Sg5u9a"

X-TIMESTAMP: 2020-12-21T17:48:41+07:00

X-SIGNATURE: 85be817c55b2c135157c7e89f52499bf0c25ad6eeebe04a986e8c862561b19a5

ORIGIN: www.hostname.com

X-PARTNER-ID: 82150823919040624621823174737537

X-EXTERNAL-ID: 41807553358950093184162180797837

X-IP-ADDRESS: 172.24.281.24

X-DEVICE-ID: 09864ADCASA

X-LATITUDE: -6.1617169

X-LONGITUDE: 106.6643946

CHANNEL-ID: 95221

{

"partnerReferenceNo":"2020102900000000000001",

"customerNumber":"6281388370001",

"accountType":"tabungan",

"beneficiaryAccountNumber":"8377388292",

"beneficiaryBankCode":"002",

"amount":{

"value":"10000.00",

"currency":"IDR"

},

"sessionId":"0UYEB77329002HY",

"additionalInfo":{

"deviceId":"12345679237",

"channel":"mobilephone"

}

}

Sample Response

Content-type: application/json

X-TIMESTAMP: 2020-12-21T17:48:45+07:00

{

"responseCode":"2004300",

"responseMessage":"Request has been processed successfully",

"referenceNo":"2020102977770000000009",

"partnerReferenceNo":"2020102900000000000001",

"transactionDate":"2020-12-21T17:48:41+07:00",

"referenceNumber":"REF993883",

"additionalInfo":{

"deviceId":"12345679237",

"channel":"mobilephone"

}

}

RESPONSES CODE

Response status merupakan informasi yang diberikan oleh service provider kepada service consumer pada response body, sebagai indikasi hasil dari pemrosesan request yang diterima.

Response status terdiri dari 2 komponen, yaitu kode (response code) dan deskripsinya (response message).

| Komponen | Tipe Data | Length | Keterangan |

|---|---|---|---|

| responseCode | String | 7 | response code = HTTP status code + service code + case code |

| responseMessage | String | 150 |

Daftar Response Code

| Category | HTTP Code | Service Code | Case Code | Response Message | Description |

|---|---|---|---|---|---|

| Success | 200 | any | 00 | Successful | Successful |

| Success | 202 | any | 00 | Request In Progress | Transaction still on process |

| System | 400 | any | 00 | Bad Request | General request failed error, including message parsing failed. |

| Message | 400 | any | 01 | Invalid Field Format {field name} | Invalid format |

| Message | 400 | any | 02 | Invalid Mandatory Field {field name} | Missing or invalid format on mandatory field |

| System | 401 | any | 00 | Unauthorized. [reason] | General unauthorized error (No Interface Def, API is Invalid, Oauth Failed, Verify Client Secret Fail, Client Forbidden Access API, Unknown Client, Key not Found) |

| System | 401 | any | 01 | Invalid Token (B2B) | Token found in request is invalid (Access Token Not Exist, Access Token Expiry) |

| System | 401 | any | 02 | Invalid Customer Token | Token found in request is invalid (Access Token Not Exist, Access Token Expiry) |

| System | 401 | any | 03 | Token Not Found (B2B) | Token not found in the system. This occurs on any API that requires token as input parameter |

| System | 401 | any | 04 | Customer Token Not Found | Token not found in the system. This occurs on any API that requires token as input parameter |

| Business | 403 | any | 00 | Transaction Expired | Transaction expired |

| System | 403 | any | 01 | Feature Not Allowed [Reason] | This merchant is not allowed to call Direct Debit APIs |

| Business | 403 | any | 02 | Exceeds Transaction Amount Limit | Exceeds Transaction Amount Limit |

| Business | 403 | any | 03 | Suspected Fraud | Suspected Fraud |

| Business | 403 | any | 04 | Activity Count Limit Exceeded | Too many request, Exceeds Transaction Frequency Limit |

| Business | 403 | any | 05 | Do Not Honor | Account or User status is abnormal |

| System | 403 | any | 06 | Feature Not Allowed At This Time. [reason] | Cut off In Progress |

| Business | 403 | any | 07 | Card Blocked | The payment card is blocked |

| Business | 403 | any | 08 | Card Expired | The payment card is expired |

| Business | 403 | any | 09 | Dormant Account | The account is dormant |

| Business | 403 | any | 10 | Need To Set Token Limit | Need to set token limit |

| System | 403 | any | 11 | OTP Blocked | OTP has been blocked |

| System | 403 | any | 12 | OTP Lifetime Expired | OTP has been expired |

| System | 403 | any | 13 | OTP Sent To Cardholer | initiates request OTP to the issuer |

| Business | 403 | any | 14 | Insufficient Funds | Insufficient Funds |

| Business | 403 | any | 15 | Transaction Not Permitted.[reason] | Transaction Not Permitted |

| Business | 403 | any | 16 | Suspend Transaction | Suspend Transaction |

| Business | 403 | any | 17 | Token Limit Exceeded | Purchase amount exceeds the token limit set prior |

| Business | 403 | any | 18 | Inactive Card/Account/Customer | Indicates inactive account |

| Business | 403 | any | 19 | Merchant Blacklisted | Merchant is suspended from calling any APIs |

| Business | 403 | any | 20 | Merchant Limit Exceed | Merchant aggregated purchase amount on that day exceeds the agreed limit |

| Business | 403 | any | 21 | Set Limit Not Allowed | Set limit not allowed on particular token |

| Business | 403 | any | 22 | Token Limit Invalid | The token limit desired by the merchant is not within the agreed range between the merchant and the Issuer |

| Business | 403 | any | 23 | Account Limit Exceed | Account aggregated purchase amount on that day exceeds the agreed limit |

| Business | 404 | any | 00 | Invalid Transaction Status | Invalid transaction status |

| Business | 404 | any | 01 | Transaction Not Found | Transaction not found |

| System | 404 | any | 02 | Invalid Routing | Invalid Routing |

| System | 404 | any | 03 | Bank Not Supported By Switch | Bank not supported by switch |

| Business | 404 | any | 04 | Transaction Cancelled | Transaction is cancelled by customer |

| Business | 404 | any | 05 | Merchant Is Not Registered For Card Registration Services | Merchant is not registered for Card Registration services |

| System | 404 | any | 06 | Need To Request OTP | Need to request OTP |

| System | 404 | any | 07 | Journey Not Found | The journeyId cannot be found in the system |

| Business | 404 | any | 08 | Invalid Merchant | Merchant does not exist or status abnormal |

| Business | 404 | any | 09 | No Issuer | No issuer |

| System | 404 | any | 10 | Invalid API Transition | Invalid API transition within a journey |

| Business | 404 | any | 11 | Invalid Card/Account/Customer [info]/Virtual Account | Card information may be invalid, or the card account may be blacklisted, or Virtual Account number maybe invalid. |

| Business | 404 | any | 12 | Invalid Bill/Virtual Account [Reason] | The bill is blocked/ suspended/not found. |

| Virtual account is suspend/not found. | |||||

| Business | 404 | any | 13 | Invalid Amount | The amount doesn't match with what supposed to |

| Business | 404 | any | 14 | Paid Bill | The bill has been paid |

| System | 404 | any | 15 | Invalid OTP | OTP is incorrect |

| Business | 404 | any | 16 | Partner Not Found | Partner number can't be found |

| Business | 404 | any | 17 | Invalid Terminal | Terminal does not exist in the system |

| Business | 404 | any | 18 | Inconsistent Request | Inconsistent request parameter found for the same partner reference number/transaction id |

| It can be considered as failed in transfer debit, but it should be considered as success in transfer credit. | |||||

| Considered as success: | |||||

| - Transfer credit = (i) Intrabank transfer; (ii) Interbank transfer; (iii) RTGS transfer; (iv) SKNBI transfer; | |||||

| - Virtual account = (i) Payment VA; (ii) Payment to VA; | |||||

| - Transfer debit = (i) Refund payment; (ii) Void; | |||||

| Considered as failed: | |||||

| - Transfer credit = (i) Transfer to OTC; | |||||

| - Transfer debit = (i) Direct debit payment; (ii) QR CPM payment; (iii) Auth payment; (iv) Capture; | |||||

| Business | 404 | any | 19 | Invalid Bill/Virtual Account | The bill is expired. |

| Virtual account is expired. | |||||

| System | 405 | any | 00 | Requested Function Is Not Supported | Requested function is not supported |

| Business | 405 | any | 01 | Requested Opearation Is Not Allowed | Requested operation to cancel/refund transaction Is not allowed at this time. |

| System | 409 | any | 00 | Conflict | Cannot use same X-EXTERNAL-ID in same day |

| System | 409 | any | 01 | Duplicate partnerReferenceNo | Transaction has previously been processed indicates the same partnerReferenceNo already success |

| System | 429 | any | 00 | Too Many Requests | Maximum transaction limit exceeded |

| System | 500 | any | 00 | General Error | General Error |

| System | 500 | Any | 01 | Internal Server Error | Unknown Internal Server Failure, Please retry the process again |

| System | 500 | Any | 02 | External Server Error | Backend system failure, etc |

| System | 504 | any | 00 | Timeout | timeout from the issuer |

APLIKASI PENGUJIAN

Akses Terbatas, Mohon Sign Up untuk Dapat Mengakses Halaman Ini